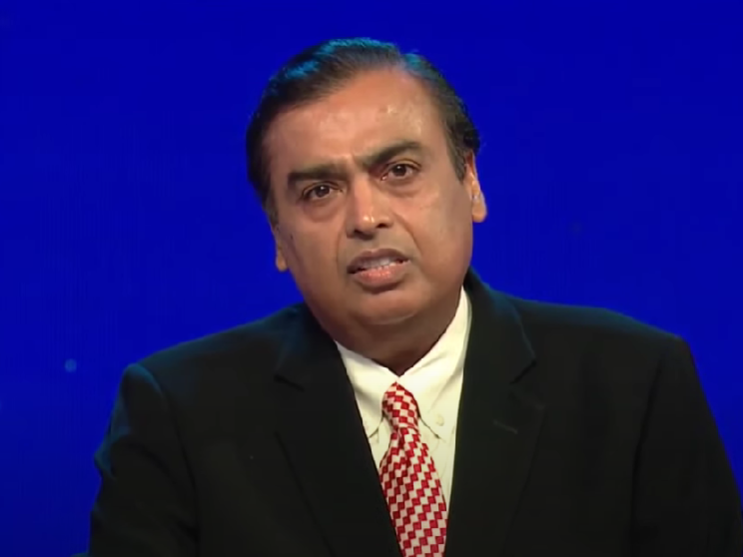

What you need to know about Reliance’s 1:1 bonus issuance, Q2 preview, and stock strategy Reliance Industries Limited is set to issue a 1:1 bonus for its shareholders, a move that aims to reward them for their continued support. In addition, a Q2 preview has been provided, giving investors valuable insights into the company’s performance. To further enhance its stock strategy, Reliance plans to capitalize on emerging opportunities and leverage its diverse portfolio.

Investors will be keenly monitoring important events as the company works toward a more diverse future, particularly the status of the ₹75,000 crore investment in the new energy division.

A 1:1 bonus share issuance has been approved by Reliance Industries Limited (RIL), giving shareholders one extra fully paid-up equity share for every ₹10 share they now own. In India’s stock market, this will be the biggest issuance of bonus shares. It is unknown exactly when the issue was recorded.

At the Board meeting on October 14, which will also cover RIL’s unaudited financial results for the quarter and half-year ended September 30, the record date is anticipated to be decided.

It has been said that the bonus issuance, which falls during the holiday season, is a “early Diwali gift” from the corporation to its shareholders.

Reliance’s second-quarter earnings for FY2025 are anticipated to provide a mixed picture in terms of financial performance. Stronger refining margins might lead to a fall in the oil-to-chemicals industry, while consumer-facing companies like Jio and retail are expected to do well.

The retail division of Reliance is expected to expand gradually, with an expected 7% annual increase in EBITDA. Recent rate increases are expected to propel Jio’s development, with EBITDA forecast to increase by 12% annually.

Investors will be keenly monitoring important events, such as progress on the ₹75,000 crore investment in the new energy industry, retail expansion, and changes in telecom pricing, as the company moves toward a more diverse future.

Brokerage perspective

Nuvama predicts that Reliance Industries’ EBITDA may decline by 5.5% on an annual basis, mostly as a result of weakening in the oil-to-chemicals (O2C) market. Strong results in customer-facing industries like retail and Jio, however, could somewhat counteract this drop. In contrast, Motilal Oswal projects a 2% yearly increase in consolidated EBITDA, or ₹39,700 crore. Due to a significant 62% year-over-year decline in Singapore refining margins, the O2C sector is projected to have a difficult quarter. EBITDA from this segment is expected to decline by 26-27%, to about ₹14,100 crore. A 3% increase in output is predicted to fuel a 4% improvement in the company’s oil and gas EBITDA.

Based on predictions from Nuvama and Motilal Oswal, retail profitability is expected to continue to be good, with EBITDA growth of 7–10% annually. Because of the recent rate increases, Reliance Jio is also anticipated to report strong profits.

It is anticipated that Jio’s EBITDA will increase by 12% yearly, with 5% growth in ARPU offsetting a little decline in the number of subscribers. Both brokerages predict consecutive increases in ARPU of 7%, which would be consistent with the telecom industry’s stable performance.

RIL’s securities trading window has been closed since October 1, 2024, in accordance with SEBI requirements. It will stay closed for 48 hours until the announcement of the financial results.

Given that Reliance shares have already experienced a dramatic correction in recent sessions, analysts view any decline in the stock price as a buying opportunity for long-term investors. While Reliance recorded a 2% increase in EBITDA in the preceding quarter, Anshul Jain, Head of Research at Lakshmishree Investment, pointed out that net profit fell by 5%. If there are any good surprises in the next financial reports, which are due on October 14, there may be opportunity for gains.

Technically speaking, Reliance’s stock has fallen below significant moving averages and is presently trading at about ₹2,744. Choice Broking’s executive director, Sumeet Bagadia, noted that the stock has resistance between ₹2,900 and ₹2,950 and support around ₹2,700. The stock may drop below ₹2,650 if it breaks below ₹2,700, while a break above resistance may start a positive trend. In order to predict Reliance’s future move, traders need keep a careful eye on these levels.

Disclaimer: The above article is for educational and news purposes, this is not a buying or selling recommendation. TraderPulse recommends that users to check with certified experts before making any investment decisions.