L&T’s share price surges 6%, Should you buy or wait for correction

Following the company’s release of a strong set of September quarter results on October 30, 2024, the price of L&T shares increased.

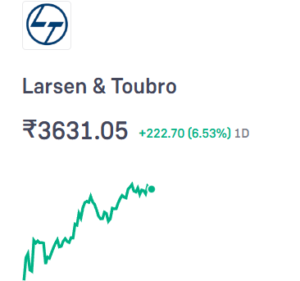

L&T share price: On Thursday, October 31, 2024, shares of Larsen and Toubro (L&T), a significant player in the engineering and construction industries, increased by 5.61 percent to reach an intraday high of Rs 3,598.40 per share.

Following the company’s release of a strong set of September quarter results on October 30, 2024, which satisfied market expectations, the price of L&T shares increased.

From Rs 3,223 crore in the September quarter of FY24 to Rs 3,395.3 crore in the September quarter of FY25, L&T’s net profit increased 5.4% year over year (Y-o-Y).

In comparison to Rs 51,024 crore in the same quarter of the previous fiscal year, the company’s topline, or revenue from operations, increased by 20.6% yearly to Rs 61,554.6 crore.

Earnings before interest, tax, depreciation, and amortisation increased 13% year over year to Rs 6,362 crore in Q2FY25 from Rs 5,632 crore in Q2FY24.

But the EBITDA margin suffered, dropping 70 basis points (bps) to 10.3 percent in Q2FY25 from 11% in Q2FY24.

“Despite the ongoing global macroeconomic volatility, we have delivered yet another quarter of strong financial performance,” stated SN Subrahmanyan, chairman and managing director. The company’s production operations and projects are still doing well.

During the quarter that concluded on September 30, 2024, the firm also received orders totaling Rs 80,045 crore at the group level, showing a 13% sequential rise and a 10% year-over-year drop.

We have a record order book of over Rs 5 lakh crore, which attests to our demonstrated proficiency in the fields of project management, engineering, construction, and manufacturing. In addition to strengthening our digital and sustainability footprint, our new, game-changing investments in semiconductor design, data centers, green energy, and digital platforms will enhance our present business portfolio.

Due to sustained state capital expenditures and a discernible rebound in private investment, India’s economic narrative is still intact. We anticipate that the momentum for Middle East Capex will continue to be strong. The company is still dedicated to providing a consistent growth performance,” Subrahmanyan continued.

L&T topped Street’s Q2 EBITDA/PAT projection by 4%/6 percent, according to Nuvama analysts. This was due to strong execution (+21% Y-o-Y), with core operating profit margins (OPMs) at 7.6% (+20bp Y-o-Y) appearing to have bottomed out. Order inflow projection is maintained at 10% YoY increase, indicating a strong H2FY25, despite order inflows declining 10.2% YoY as a result of high-base hydrocarbon orders of Rs 40,000 last year. Strong revenue visibility (~2.3x FY24 sales) is provided by an order book that has reached an all-time high of over Rs 5 trillion.

Since the company has underperformed since our downgrading in January 2024, experts have upgraded L&T to a “Buy” on price correction. With 8.2 percent core OPMs (topped out), the brokerage has maintained its FY25 target of 10 percent/15 percent order inflow/sales growth. In H2, a significant order inflow is anticipated in India and the Middle East.

Prospects

The government’s structural changes during the last ten years, the company is sure, would improve the quality of India’s growth and provide a strong basis for the realization of a Viksit Bharat by 2047.

In a statement, L&T stated that it is still dedicated to pursuing technology-driven expansion and providing steady, lucrative returns to all of its stakeholders.

L&T shares were up 5.47 percent at Rs 3,593.45 at 9:23 AM. At 79,809 levels, the BSE Sensex was trading 0.17 percent down.

Disclaimer: The information in the aforementioned article is news and educational in nature; it is not a suggestion for a purchase or sale. Before making any financial decisions, users are advised by TraderPulse to consult with qualified professionals.