Price of Reliance shares: Should you purchase RIL stock Ahead of Monday’s Q2 results 2024?

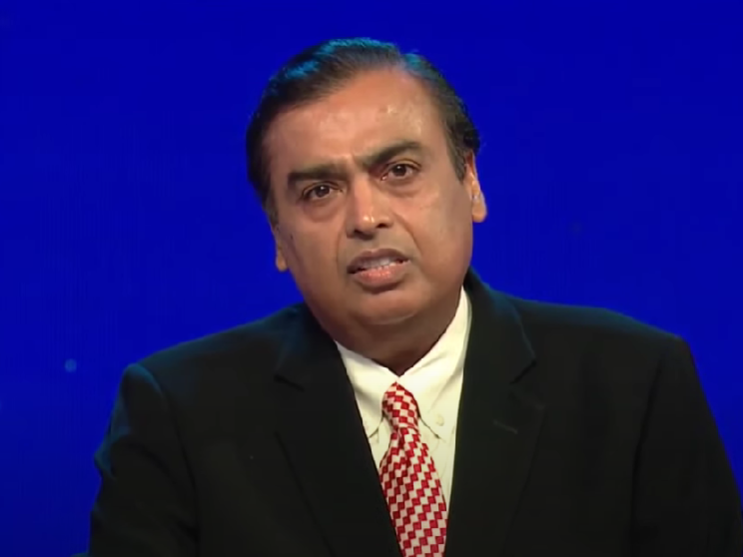

Results for IL Q2 2024: Reliance Industries, owned by Mukesh Ambani, has scheduled a board meeting for Monday of next week to discuss and approve the standalone unaudited financial statements for Q2FY25.

Reliance share price: Reliance Industries Ltd. (RIL) shares will be the subject of attention on Monday since the board of the business has scheduled a meeting for October 14, 2024, to review and approve the standalone Q2 results of the Sensex heavyweight. The company, which is owned by Mukesh Ambani, has already notified the Indian stock market exchanges of the date of its board meeting in order to release its quarterly results for Q2FY25.

A sneak peek at Reliance Industries’ Q2FY25 results

Anshul Jain, Head of Research at Lakshmishree Investment and Securities, commented on the market expectations around RIL Q2 results 2024: “On October 14, 2024, Reliance Industries’ Board is set to meet to review and approve its financial results for the quarter and half-year ending September 30.” The company reported a 2% year-over-year increase in EBITDA to ₹42,748 crore for the June 2024 quarter. However, net profit declined by 5% to ₹15,138 crore. Expectations for the next results point to a flat or muted performance. But since Reliance’s stock has already experienced a large decline from higher levels, any decrease in the wake of the findings would be a great chance for long-term investors. Furthermore, a strong increase in the stock could be sparked by any favorable surprises in the figures.

Target price for Reliance shares

What can be inferred about Reliance’s share price prospects from the technical chart? “Reliance Industries’ stock is currently trading around ₹2744, showing a slight increase of +2.10 points,” stated Sumeet Bagadia, Executive Director at Choice Broking. The stock has fallen below its 200-day, 100-day, and 50-day moving averages, which are respectively ₹2865.69, ₹2925.94, and ₹2934.39.

According to the Choice Broking expert, RIL’s share price has dropped from its peak of ₹3200 and is currently finding support at ₹2700. The next support might be at ₹2650 if this level breaks. Resistance on the upside is located between ₹2900 and ₹2950; if the stock breaks above this level, it might lead to a bullish surge.

“The short-term trend is negative, but if the stock stays above the 200-day moving average, it might stabilize. Investors should keep a careful eye on the ₹2888 resistance and ₹2700 support levels for clues about the stock’s next move. Reliance’s stock will have a clearer direction if it breaks above these levels, according to Bagadia.

Disclaimer: The above article is for educational and news purposes, this is not a buying or selling recommendation. TraderPulse recommends that users to check with certified experts before making any investment decisions.